Content Library

Don’t just take our word for it. There’s a reason Sovos products are used by over half the Fortune 500 and the world’s smartest companies.

A reactive or ad hoc approach to tax compliance across the markets you do business in can mean the authorities have a better overall view of your data than your own internal teams. How confident are you that you have the same view of your data as the tax authorities?

As manufacturers learn to operate in an uncertain environment, they must understand how rapidly changing EU VAT complexities impact their business operations. Non-EU based manufacturers have especially high audit exposure – a risk that only grows with expansion. Additionally, manufacturers making the ecommerce push must remain vigilant to stay compliant.

Insurance Premium Tax (IPT) can be complex with fragmented rules and requirements levied by the many different tax authorities in the jurisdictions where this tax applies. This only adds to the challenges faced by finance teams when calculating and settling IPT accurately and on time.

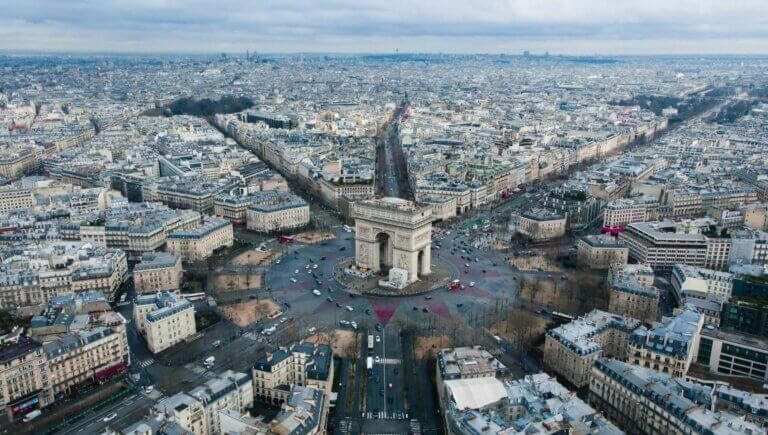

France – Mandatory B2Be-Invoicing 2024 Faced with a VAT gap of nearly €13 billion, France is introducing mandatory e-invoicing for business-to-business (B2B) transactions from 2024, as well as e-reporting of additional data types. Applying to all companies established or, for e-reporting, VAT-registered in France, this new mandate is complex. It will also require significant planning. […]

Periodic VAT reporting takes time. Data must be accurate, its format must be correct, deadlines cannot be missed and additionally the frequency of submissions puts significant pressure on teams responsible for VAT reporting.